ETF Junction unveils platform to tap INR 5 lakh crore ETF market in India

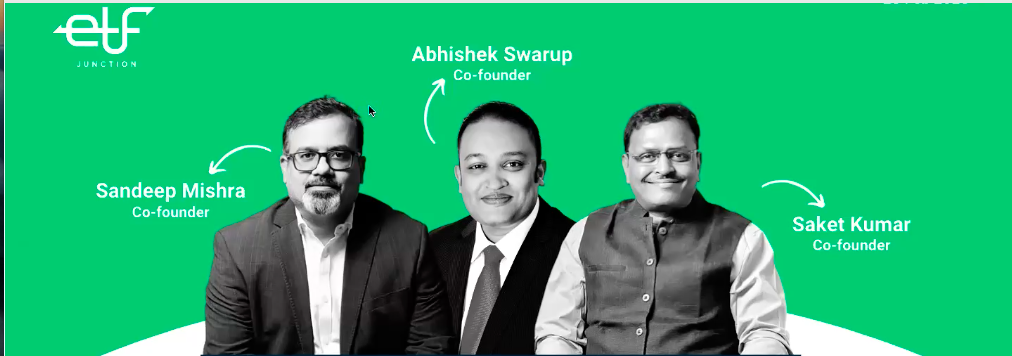

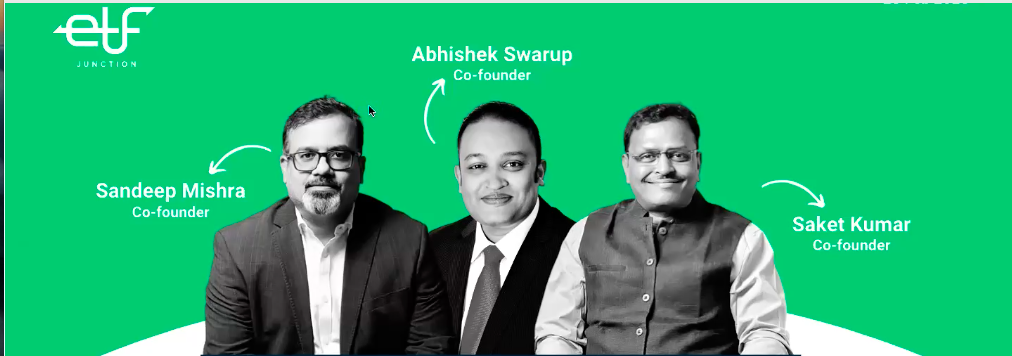

02 March 2023, National: Industry veterans Sandeep Mishra, Saket Kumar and Abhishek Swaroop along with their technology partner Abhishek Swarup launched ETF Junction, India’s first Fintech platform dedicated to Exchange Traded Funds (ETFs). ETF Junction aims to create a complete ecosystem involving Mutual Funds, Investors, Advisors & Influencers/experts and help retail investors to expand their investment horizon to Exchange Traded Funds (ETFs).

Through the platform, investors can now access 9500+ Indian & International ETFs, more than 660 Global ETF Issuers, 165 Global Stock Exchanges and a 10 trillion USD Global AUM using industry-first tools. AI powers ETF Junction’s intelligent algorithm to bring new investors to the ETF ecosystem with relevant news, articles, and research; exclusive to requirements & preferences. The platform has signed up with Asset Management Companies to create awareness campaigns for educating investors on the benefits of ETFs. It addresses the underlying challenge of lack of infrastructure and awareness about Exchange Traded Funds (ETFs) beyond traditional Mutual Funds.

The platform intends to create an ETF-exclusive investment community where investors can share their investment thoughts and concerns, engage with peers and learn all about ETFs from experts and verified influencers. The ETF with its vast diversified offerings stands as a great investment avenue for both new -age as well as traditional investors.

Sandeep Mishra, Co-Founder of ETF Junction, said, “The ETF market in India is worth 5 lakh crores at the moment, compared to the approximately 40-42 lakh crore Mutual fund market. ETF Junction aims to educate the general public about how an ETF can offer lower operating costs than traditional open-end funds, flexible trading, and greater transparency.”

He adds, “ETFs have demonstrated an annual growth of 22% in the last 10 years in the international markets. Currently the global ETF market size is approx. 10 trillion USD and is expected to touch 20 trillion dollars by 2026. We foresee a similar trend in India within the next 3-5 years. ETF Junction aims to become a one-stop solution for everything ETF and gradually help approx. 3.5 crore MF retail investors and 10.8 cr demat account holders to expand their investment horizon to Exchange Traded Funds (ETFs). Currently, 30 lakh investors are investing in ETFs, our aim is to tap the first timer ETF investors, get in more folios from the mutual fund investors and gradually try for a pie from the stock investors. We are targeting to achieve at least 10% market share within 2 years.”

SEBI has introduced new guidelines to make the ecosystem viable for investors and foster more ETF transactions on exchanges. The regulation changes effectively addressed improving the liquidity, tracking error limits and limiting disclosures for exchange traded funds (ETFs) and index funds. Since the implementation of these regulations in May 2022, exchanges have witnessed a substantial increase in trading from retail investors. The primary bottleneck to the growth of the ETF industry in India remains the need for proper infrastructure and the absence of awareness amongst investors.

Chintan Haria, Head- Investment Strategy, ICICI Prudential Asset Management, said “India’s evaluation as a non-financial saving country to becoming a financial saving showcases the growth in investment avenues from insurance, fixed income sources. ETFs are the extension of opportunities for investors. New age solutions like ETF Junction are further helping for higher penetration and inching towards financial inclusion by educating and providing experts access to retail investors. With 20+ ETFs products launched in the last 2 years and increase in distribution along with regulators’ move enabling mutual funds to incentivise market makers has created a strong foundation for the equity market to grow at a greater height.”

During the last 5 years, passive funds AUM in India has increased from ₹52,368 crores on 31 March 2017 to Rs. 4,99,319 crores on 31 March 2022 (annualized growth rate of 57%). During this period, the number of passive funds available in India has also grown from 84 in March 2017 to 228 in March 2022.